Global Action: Establish Carbon Markets to Address the Climate Change

The world is facing the severe challenge of climate change, and the international community is actively taking various actions to address the relevant crisis and promote a green economic transition. Among these efforts, carbon market, as a cost-effective market-based mechanism, play a crucial role in promoting emission reduction and achieving sustainable development goals. Currently, an increasing number of countries and regions are establishing their own carbon market systems to achieve greenhouse gas (GHG) emission reduction targets.

The core of mandatory carbon markets is the Emissions Trading Systems (ETSs). Under the ETSs, the government sets emission caps for specific industries or companies and allocates corresponding emissions allowances. Companies must ensure that their actual emissions do not exceed their allowance, otherwise they may face penalties. If a company’s emissions are below its allowances, it can sell the surplus allowances to other companies in need to reduce their overall emission level, thus forming a market-based emission reduction mechanism. The European Union Emissions Trading System (EU ETS) [1] is one of the largest and most mature mandatory carbon markets globally. It has significantly driven the emissions reduction progress in Europe since its launch in 2005.

On the other hand, the Voluntary Carbon Markets (VCMs) offer opportunities for companies or individuals who are not subjected to mandatory emissions reduction requirements to participate in emission reduction efforts. Through participating VCMs, participants can voluntarily purchase carbon credits generated by emission reduction projects, to offset their own carbon emissions. These projects may include afforestation, development and utilization of renewable energy, Carbon Capture, Utilization and Storage (CCUS), etc. According to the report "Road to Carbon Neutrality: Hong Kong's Role in Capturing the Rise of Carbon Market Opportunities" by the Financial Services Development Council of Hong Kong, the total trading value of global VCMs in 2021 was approximately US$2 billion [2], nearly tripling from 2020.

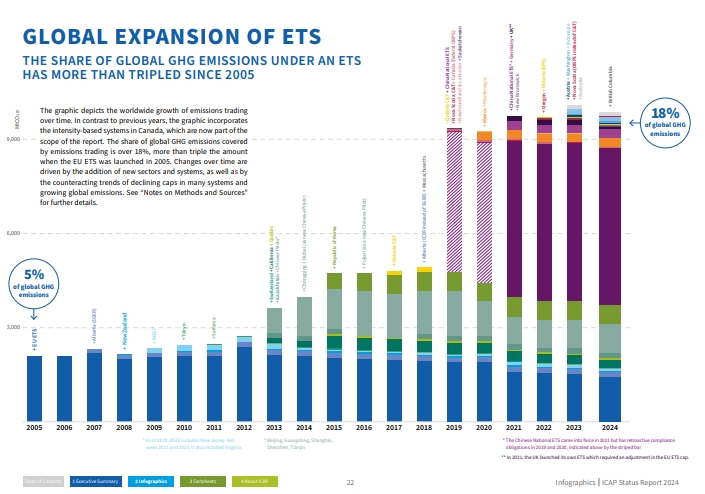

The Status Report released by the International Carbon Action Partnership (ICAP) in April 2024 indicates that currently, there are 36 ETSs in operation throughout the world, with 14 under development and 8 under consideration. Existing ETSs cover around 18% of global GHG emissions (see Figure 1), equivalent to nearly 9.9 billion tons of CO2 equivalent (CO2e). This figure is triple the size of the EU carbon market when it was launched in 2005 . Furthermore, global ETSs revenues reached a new record of around US$74 billion in 2023, reflecting the robust development of global carbon market and highlighting proactive attitude of governments and businesses of the world in addressing climate change.

Figure 1: The Global Expansion of ETS (2005-2024)

In contrast, due to their voluntary nature, VCMs are currently much smaller in scale compared to mandatory carbon markets. The S&P Global report "A Tale of Two Carbon Markets" shows that, after significant growth in recent years, VCMs faced a credibility crisis in 2023. Media scrutiny raised buyers' doubts about the quality and authenticity of VCMs carbon credits. The growth trend of global VCMs began to slow in 2023, with slight decline in both carbon credits supply and the end-users demand.

Consequently, the international community is actively promoting the establishment of high-quality standards in order to address the integrity challenges faced by VCMs last year. They are seeking independent governing bodies, such as the Integrity Council for the Voluntary Carbon Market (ICVCM), to develop standards or labels to provide recognition for verified high-quality carbon credits. As more companies commit to achieving net-zero emissions, demand for VCMs is expected to keep growing. The 2023 research report "The Growth of Global Carbon Markets and Opportunities for Hong Kong" by the Hong Kong Exchanges and Clearing Limited (HKEX) also indicates that market analysis estimates global VCMs carbon trading value could reach US$ 245 billion to US$ 546 billion by 2050 .

While the global carbon market has a promising outlook it also faces a lot of challenges

including market risks from carbon price volatility, potential speculative behavior due to lack of transparency in the market, and issues with carbon credit quality control and standardization. To address these challenges, the future development of the carbon market requires a multi-pronged approach, such as improving the pricing mechanism to stabilize carbon prices, enhancing market transparency to prevent manipulation, optimizing quality control to ensure the authenticity of emission reduction results, strengthening international cooperation to achieve cross-border carbon trading and cultivating diverse market participants to enhance market vitality. Successful implementation of these measures requires the joint efforts of all governments, businesses, and various sectors of society, as well as long-term, sustained policy support and institutional innovation. As emphasized by the International Energy Agency (IEA) in its report "Implementing Effective Emissions Trading Systems: Lessons from International Experiences" , by continuously optimization of the carbon market policy frameworks and regulatory systems, carbon markets are expected to become more powerful tools, effectively promoting the realization of global emission reduction goals and making positive contributions to climate change mitigation.

Looking forward

We are confident in the future of Hong Kong carbon market. As a professional ESG advisory firm, Baker Tilly Hong Kong has a thorough understanding of the complexity of the carbon market and its profound impact on businesses.

Our expert team, with extensive experience in carbon emission calculation, is committed to provide forward-looking insights and guidance to Hong Kong companies in this emerging field. Our vision is to become a significant force in promoting Hong Kong’s sustainable development, assisting companies in discovering opportunities and managing risks in the process of addressing climate change. Through close collaboration with government agencies, businesses and community partners, we will work together to build an efficient and transparent carbon market ecosystem. In this era full of challenges and opportunities, Baker Tilly Hong Kong will continue to stand at the forefront of the industry, contributing our professional expertise to Hong Kong's green future.

1. https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets_en

2. https://www.fsdc.org.hk/media/4plathbr/20230202-fsdc-carbon-paper-en.pdf

3. https://icapcarbonaction.com/system/files/document/240522_report_final.pdf