Download the newsletter

On 28 February 2024, Mr. Paul Chan, Financial Secretary, delivered his eighth budget speech. He forecasts a 2.5% to 3.5% GDP growth in 2024. The theme of this year’s budget is “Advance with Confidence, Seize Opportunities and Strive for High-quality Development”. A fiscal consolidation strategy will be adopted to narrow down Hong Kong’s fiscal deficit progressively.

Profits tax

- Reducing Profits Tax by 100% for 2023/24, subject to a ceiling of HKD3,000.

- Allowing tax deduction for expenses incurred in reinstating the condition of the leased premises to their original condition starting from the year of assessment 2024/25.

- Removing the time limit for claiming allowance for industrial buildings and structures and commercial buildings and structures starting from the year of assessment 2024/25. This will allow the new owner to claim allowances for the property after a change of ownership, subject to the factors such as the construction cost of the property and the balancing charge claimed by its previous owner.

Salaries tax

- Reducing Salaries Tax and tax under personal assessment by 100% for 2023/24, subject to a ceiling of HKD3,000.

New International Tax Standard – Base Erosion and Profit Shifting (BEPS2.0)

- Aiming to apply the global minimum tax rate of 15% on large multinational enterprise groups with an annual consolidated group revenue of at least EUR750 million and impose the Hong Kong minimum top-up tax starting from 2025.

Rates

- Waiving rates for non-domestic and domestic properties for the first quarter of 2024/25, subject to a ceiling of HKD1,000.

Stamp duty

- Cancelling Special Stamp Duty, Buyer’s Stamp Duty and New Residential Stamp Duty for residential properties with immediate effect.

Financial services

- Issuing HKD20 billion of retail green bonds and infrastructure bonds; and HKD50 billion of Silver Bond in 2024/25.

- Enhancing preferential regimes for family office funds.

- Extending the Grant Scheme for Open-ended Fund Companies and Real Estate Investment Trusts for 3 years.

Other relief measures

- Waiving stamp duties payable on the transfer of real estate investment trust (REIT) units and the jobbing business of option market-makers.

- Extending the first registration tax (FRT) concessions for electric vehicles to March 2026, with FRT reduced by 40%.

- Maximum FRT concession under the “One for One Replacement” Scheme: HKD172,500

- Concession ceiling for general electric private cars: HKD58,500

- Not applicable to electric private cars valued at over HKD500,000 before tax

- Introducing legislative proposal to implement “patent box” tax incentive. Profit Tax rate is to be reduced to 5%.

- Studying enhancements to tax concession measures for the maritime industry.

- Extending the application period for the 80% and 90% Guarantee Products under the SME Financing Guarantee Scheme for two years to the end of March 2026.

Measures to increase revenue

- Increasing business registration fees by HKD200 to HKD2,200 per annum from 1 April 2024. The business registration levy of HKD150 will be waived for 2 years.

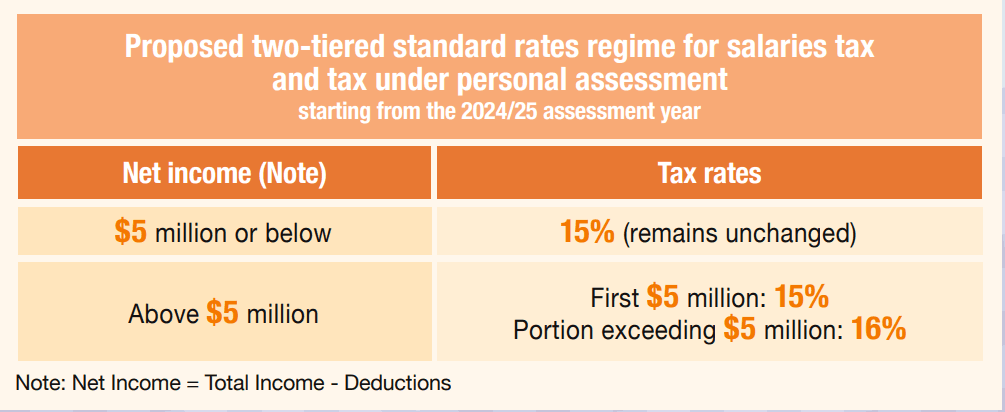

- Implementing a two-tier standard rate regime for salaries tax and tax under personal assessment starting from 2024/25:-

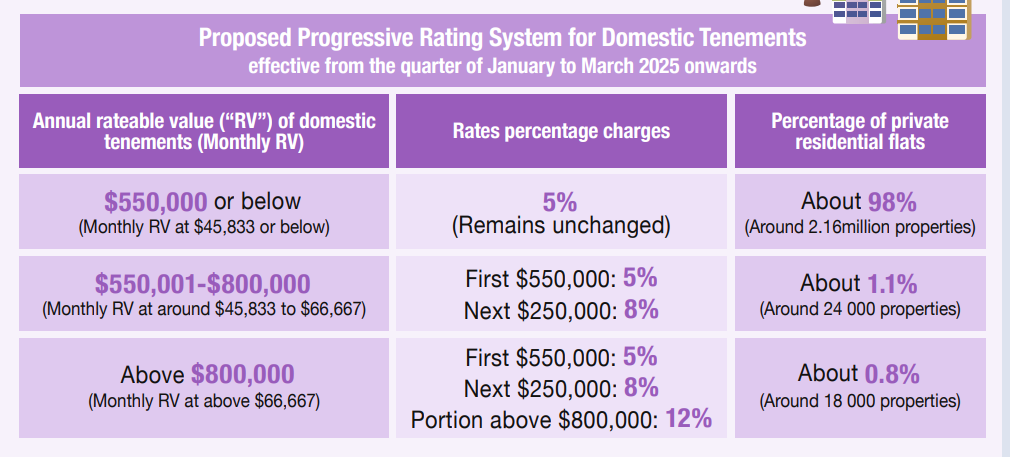

- Implementing the progressive rating system for domestic properties (effective from the quarter of January to March 2025 onwards):-

- Resuming the collection of the Hotel Accommodation Tax at 1 rate of 3% starting from 1 January 2025.