Patent box regime come into force – Concessionary 5% tax rate for eligible onshore IP income [只提供英文版本]

Snapshot

The Hong Kong Government has recently introduced a "patent box" tax regime in Hong Kong, which provides a concessionary profits tax rate of 5% on certain Hong Kong-sourced intellectual property (“IP”) income derived by taxpayers in Hong Kong. This concessionary tax regime applies retrospectively from the year of assessment 2023/24.

For IP income which is sourced outside Hong Kong (i.e. offshore IP income), it will continue to be exempt from Hong Kong profits tax to the extent the offshore IP income is related to a nexus ratio on certain qualifying expenditure for IP developed. For details, please refer to our tax article published in December 2022 regarding the Refined Foreign-sourced Income Exemption Regime, which has taken effect since 1 January 2023.

Development of the regime

In the Hong Kong 2023-24 Budget Speech given by the Financial Secretary on 22 February 2023, the Government indicated that it would introduce a patent box regime to provide tax incentives for certain Hong Kong-sourced profits derived from qualifying patents generated through research and development (“R&D”) activities. This is to encourage the innovation and technology sectors to carry out more R&D activities and create more patented inventions.

After the public consultation and legislative process, the Inland Revenue (Amendment) (Tax Concessions for Intellectual Property Income) Ordinance 2024 (“the Ordinance”) was gazetted on 5 July 2024 to implement the patent box regime in Hong Kong.

The Commerce & Economic Development Bureau indicated that the patent box regime will encourage enterprises to forge ahead with more R&D activities in Hong Kong and promotes IP trading, thereby enhancing Hong Kong’s competitiveness as a regional IP development and trading centre.

Tax concession

A taxpayer who fulfils specified requirements under the patent box regime may enjoy a reduced profits tax rate of 5% on the concessionary portion of its Hong Kong-sourced eligible IP income.

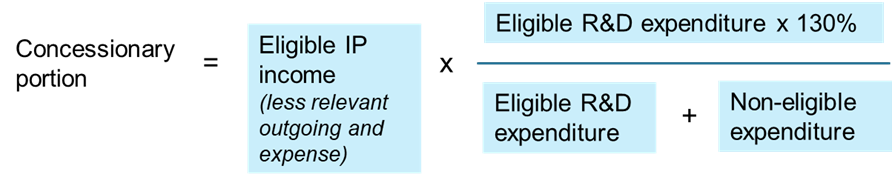

The “concessionary portion” is determined based on a “nexus ratio” calculated by reference to qualifying R&D expenditure as a proportion of overall expenditure incurred to develop the IP asset (further explained below).

The eligible IP incomes should be derived from certain patents, plant variety rights and copyrighted software. In other words, the tax concessions under patent box regime do not apply to trademarks or other marketing-related IP.

Key requirements for the tax concession

Broadly speaking, a taxpayer needs to fulfil the following requirements to enjoy the tax concession under the patent box regime: -

- The taxpayer is an eligible person;

- The taxpayer derives eligible IP income from an eligible IP; and

- An irrecoverable election is made by the taxpayer.

Eligible person

“Eligible person” means a person who is entitled to derive eligible IP income from an eligible intellectual property. The person does not need to be the legal owner of an IP and does not need to be a standalone entity which only derives IP income.

Eligible IP

“Eligible IP” mainly includes the following: -

- Eligible patent* – a patent granted / patent application filed in Hong Kong or overseas jurisdictions.

- Eligible plant variety right* – a right granted / application made under the laws in Hong Kong or overseas jurisdictions.

- Copyright subsisting in software – copyrighted software registered under or protected by relevant laws in Hong Kong or overseas jurisdictions.

*After a grace period of 24 months (since the commencement date of the Ordinance), taxpayers will need to obtain local registration for the patents or plant variety rights in Hong Kong to enjoy the patent box tax incentive.

Eligible IP income

“Eligible IP income” mainly includes the following: -

- Income derived from an eligible IP for the exhibition or use of the property or the imparting of knowledge connected with the use of the property (e.g. royalties).

- Disposal gain arising from the sale of an eligible IP (which is not capital in nature).

- The portion of income arising from the sale of product or service that is attributable to the value of the eligible IP.

- Amount of insurance, damages or compensation arising in connection with an eligible IP.

Nexus ratio

The 5% concessionary tax rate can only apply on the concessionary portion of eligible IP incomes. The concessionary portion is determined by the “nexus ratio” as follows: -

Notes:

- The nexus ratio and 30% uplift on eligible R&D expenditure are in line with the nexus approach promulgated by Organisation for Economic Co-operation and Development (“OECD”).

Eligible R&D expenditure refers to those arising from: -

- R&D activities undertaken by the taxpayer in or outside Hong Kong;

- R&D activities undertaken by non-associated entities in or outside Hong Kong; and

- R&D activities undertaken in Hong Kong by associated entities which are Hong Kong residents.

- The acquisition cost of eligible IP is regarded as non-eligible expenditure.

- The eligibility for the patent box regime will be assessed separately for each IP asset. If an expenditure is attributable to different IP assets, the amount should be apportioned to each IP asset on a basis which is justifiable and reasonable.

Forward planning

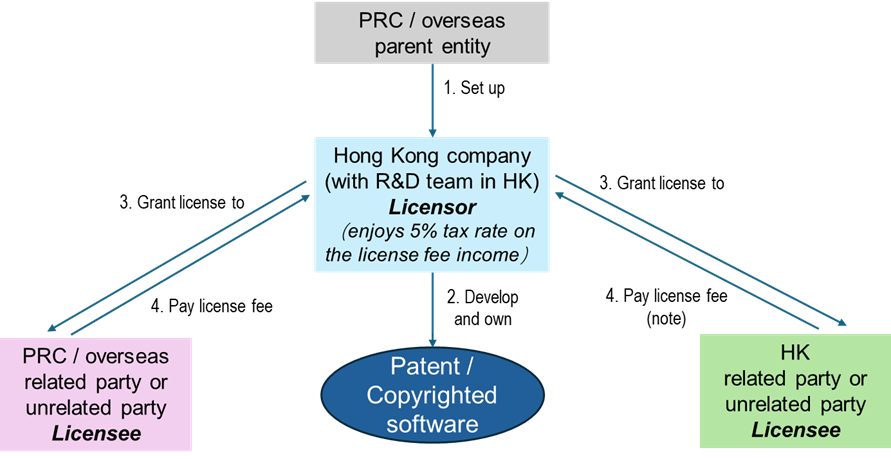

A PRC or overseas corporate group may consider setting up a Hong Kong company to develop or enhance an eligible IP (such as patent or copyrighted software) by its own R&D team in Hong Kong.

Thereafter, the Hong Kong company may grant a license to related or unrelated parties in Hong Kong or overseas for the use of or the right to use the eligible IP, and receive a licensing fee income (currently regarded as onshore since the IP is developed in Hong Kong) from such licensees.

Upon election, the Hong Kong company will then be eligible to enjoy the 5% concessionary profits tax rate for its eligible IP income based on the nexus ratio, provided that relevant conditions are met.

Notes:

- In the above scenario, while the Hong Kong company may enjoy the 5% concessionary rate for its eligible IP income based on the nexus ratio, the PRC or overseas licensees may claim tax deduction at a higher corporate tax rate (e.g. 25% standard enterprise income tax rate in the PRC).

- Also, where the licensee is a Hong Kong entity, the patent box regime allows the licensee to claim full deduction on the licensing fee made (regardless of whether it is associated with the Hong Kong licensor).

- Thus, in principle, while the Hong Kong licensor is enjoying the 5% concessionary tax rate for its eligible IP income, the Hong Kong licensee may continue to claim full deduction at standard tax rate (16.5% or 8.25%) for its licensing fee expense for Hong Kong profits tax purposes.

- Having said that, any royalty or licensing fee payments should be arm’s length and substantiated by genuine commercial reasons, otherwise such arrangements may be subject to anti-avoidance provisions or transfer pricing rules in the Inland Revenue Ordinance.

Next steps

The patent box regime in Hong Kong is a welcomed development which will encourage more R&D activities to be taken in Hong Kong to create IP assets and stimulate the development of IP trading activities. The tax concessions for eligible IP income will enhance Hong Kong’s competitiveness as a regional IP development and trading centre.

Taxpayers should review their current R&D development and licensing activities, and assess how the tax concessions under the patent box regime can reduce their tax burden via commercially reasonable arrangements. If you would like to have more information regarding the matter, please contact Mr. Joseph Lam, our Executive Director – Regional Tax, at +852 2152 2652 or by email to josephlam@bakertilly.hk.